InterventionPod

The following is a collection of the materials used in creating the thirteenth episode of the Citizen Reagan podcast about the Reagan's Radio Commentaries.

Audio

Transcript

Welcome to the Citizen Reagan podcast. As you may know, what I do with this podcast is discuss the contents of the Ronald Reagan Radio Commentaries produced between 1975 and 1979. Sometimes, I may decide to talk about some other topic, but with over 1000 of these Commentaries to cover, the bulk of my work will be on them.

I've discussed this subject before, its government interference in the marketplace. I've talked about the supply and demand curves that come from your basic microeconomics 101 course. This time Reagan's going to talk about supply and demand too.

When government meddles, it can't stop meddling. When it doesn't, some amazing things happen in the marketplace. I'll be right back. When the federal government began tinkering in earnest with the free enterprise system in the 1930s, it really opened Pandora's Box. We've learned time and again since then that government tinkering must lead to more tinkering. It was William Blake, the 18th century English poet and scholar, who said, "If you will do good for me, you must do it in the minutest particulars." Where government is concerned, the process is endless. Despite reams of regulations from the Washington bureaucrats, designed to control every aspect of a given situation, American ingenuity and that marvelous incentive to production, the profit motive, have found ways to still let this law, supply and demand, work. Think back to the wage and price controls imposed in August 1971. In the months that followed, mysterious shortages began to be felt in various common, everyday items. Most of them were caused by the freeze on prices. If you were only breaking even on your basic products and couldn't raise prices, you'd consider making alternative products that sold at higher prices. So, for example, we had fewer paper bags, but lots more greeting cards. When government pulls its hand out and let's the law of supply and demand work, that law works naturally. If prices go up, demand slacks off, prices slide down, demand goes up. The process is self-regulating. In the case of new products growing popularity and demand brings about a lowered cost of production per unit, resulting in a lower price to you and me at the store. Take color television sets, for example. When they first came out several years ago you'd pay seven or eight hundred dollars for one. Today, they sell from about two hundred dollars up. In the late 1920s, a long distance telephone call from San Francisco to New York cost $28 for three minutes. For the same amount of money, you could send 1376 letters. Today you can make that same telephone call for only $2 and a half and for that amount you can only send 25 letters. So the government's suing the phone company. Right now, there's another example of the genius of the American system at work. It's the small, handheld calculator, that little gadget that today helps the homemaker stretch your shopping budget, helps junior in his math class and aids thousands of families in paying bills and reconciling bank statements. Just two years ago, it was a luxury item, some two and a half million small calculators were sold in the U.S. and Canada. The average price: a $150. The product was so popular and filled so many diverse needs that by last year, sales had jumped to twelve million units and the average price dropped to $45. In fact, some manufacturers are selling them for as little as $13. Maybe we should send some of these calculators to the Washington bureaucrats, so they can learn something about the arithmetic of free enterprise. This is Ronald Reagan. Thanks for listening.

Today, we'll look at some corrections, education and history and see how much time is left, then maybe we'll have some commentary.

First, I looked up that William Blake line and Reagan had it mostly correct. For the record, the line is: "He who would do good to another must do it in Minute Particulars." and it comes from his poem/book entitled Jerusalem: The Emanation of the Giant Albion. What Reagan is trying to say is, if you're going to help someone out, don't put in a half effort. The trouble is, when you do something so sweeping at the Federal level, there will almost certainly be some unintended consequences.

Reagan references wage and price controls being put in place in August of 1971. This would be a reference to Nixon's Executive Order 11615 in which all wages and prices of goods (except raw agriculture) were frozen for 90 days at the level equal to their previous 30-day high. If a gas station sold gas for, at most, 50 cents per gallon last month, it must continue to be sold at that price for the next 3 months.

Next Reagan talks about supply and demand, how they exist in a constant flux. High demand with low supply results in increased prices. Think of supply and demand like a massive collection of auctions. There's only one Picasso painting. If everyone wants it, the price will be high because everyone will be trying to outbid each other. If no one wants it, the price will be low. On the flip side, if there are one billion... USB charging cords, chances are pretty high that everyone that wants one can get one and there isn't anyone offering to pay more to get one.

Supply and demand work, not just with goods you want to buy, but also with wages. Think of wages as your price. Instead of someone buying a thing, they are buying your time.Now, let's talk about government influence over supply and demand. A few years ago, I got a copy of the book "A Capitalist Manifesto" by Gary Wolfram, an economics professor at Hillsdale College. Let me read a passage:

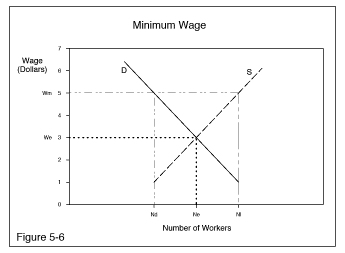

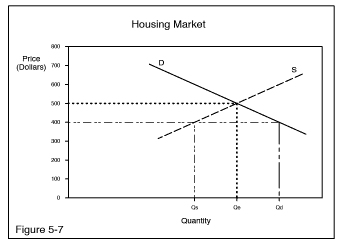

Suppose the equilibrium wage, where demand for labor equals supply for labor, is at $3 per hour. And suppose that the government determines that the minimum wage anyone can be paid is $5 per hour. The quantity of labor demanded will be less than was the case at $3 per hour, and the quantity of labor supplied will be greater than at $3 per hour. The result is unemployment.

(Seeing the charts would help.)

Why is demand reduced? Because an employer can only afford to hire a certain number of people at $3 per hour. If that employer is required to pay $5, he can’t afford to hire as many people.

Why is supply increased? Because more people will be willing to work for $5 per hour than at $3 per hour.

Too many people and too few jobs means unemployment.

When Reagan talks about the TVs and the pocket calculators, those are probably best explained by another economic principle: economies of scale. The idea is that when a new product is introduced, it costs a lot of upfront money. Research and development, testing, prototyping, factory retooling, etc. The first products made available have to be priced higher to cover at least some of these early costs. As more of the product is produced, the average cost for each goes down, so the company can afford to sell them for a lower price. There will also be additional technological breakthroughs, design refinements which can result in a cheaper and/or better product.

In Reagan's calculator example, we can see this process. In 1974, the Texas Instruments SR-50 calculator sold for $170. My father bought one and still uses it. Within 2 years, a follow-up product, the TI-30, was introduced at $25. In more recent history, we've seen the amazing development in flat-panel TVs.

What’s another way government can interfere in the free market? They can pick winners and losers through a variety of means, like tax rebates or subsidies. I recall a story I heard from around 2008-2010. General Motors had developed a clean, hydrogen fuel cell car and they were prepared to put it on the market. They also had the financial means to retool for its production, but there was no going back. If the federal government supported some other technology, it would destroy them as a company. Thankfully for them, they didn't go ahead, while the federal government put its money behind on cars powered with battery-stored electricity, giving us the Prius, Volt, Bolt, Leaf and Tesla. If I talk about Reagan's environmental broadcasts, I'll have to discuss my personal views on electric cars.

When Reagan talks about the government suing the phone company, he's talking about the anti-trust suit against AT&T which would, in 1982, break up the phone company into eight smaller organizations covering different areas of the United States... they were called the "Baby Bells." Since then, however, many of them have merged back together. One is the new AT&T, another is Verizon and the last is Lumen Technologies. Was it good to break up the original AT&T, aka "Ma Bell,"? Reagan doesn't seem to think so, because even if they were a monopoly, they were innovating and improving service, unlike the government monopoly that is the US Postal Service. Is it good or bad that these eight companies have been merging back together? My personal observation is that I don't see any widespread exploitative action coming from them. In fact, services are improving while consumer costs are going down. Seems like a win-win.

Finally, does Congress need calculators? Probably, yes, but there’s not enough room on a calculator screen for numbers they seem to deal with.